Shared Ownership

What is a Shared Ownership Mortgage?

Shared Ownership

A Shared ownership mortgage is a government scheme, also known as a part buy/part rent. It is a mortgage that gives first time buyers the chance to buy a share in a property, as opposed to buying the full property. It allows households whose income may be slightly lower to get an opportunity to move onto the property ladder at an affordable cost.

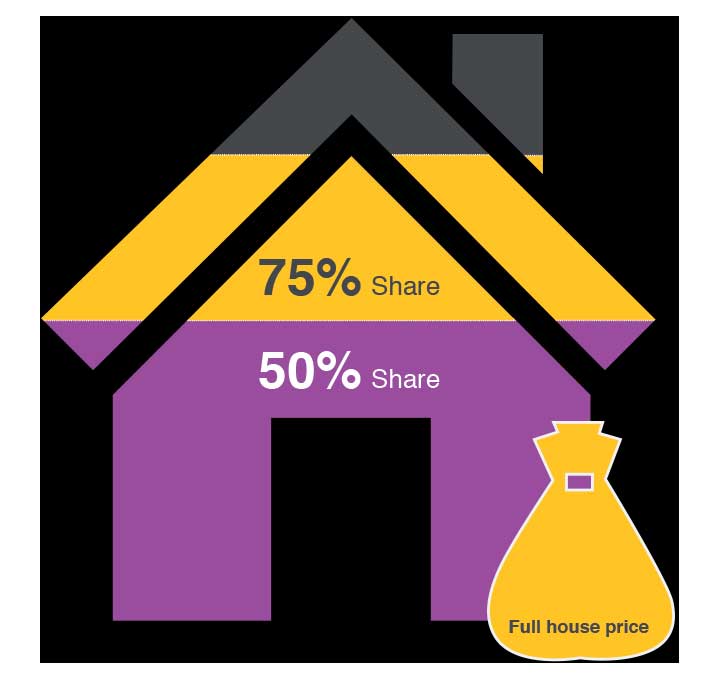

Your share of the property is usually between 25%-75%, with the non-owning share requiring a rental payment to the housing association. This allows you to take out a smaller mortgage with a lower deposit as this is only applicable on your purchase.The biggest difference between a shared mortgage and conventional mortgage is a shared mortgage is only available with certain lenders, which will mean your options are limited.

Do I qualify for the scheme?

This is one of the first things that we will evaluate with you. In order to qualify for the scheme your household income should be less than £80,000 per annum. With that, you will also need to either be a first-time buyer or previous homeowner who cannot afford to buy now. Alternatively, you may be renting from the local authority or housing association already.

Further to this, we will need to prove you are not in arrears with you rent and/or mortgage and can afford the costs involved in purchasing a shared ownership property. Our specialist team here at Pinnacle can help you find the best lender for you and help you get on the property ladder.

Can I Remortgage a Shared Ownership?

A common thought is whether you can remortgage a shared ownership mortgage as it is government backed. The short answer is, yes, you can remortgage a shared ownership a it is similar to a conventional mortgage. However you need to bear in mind that you were only lent a percentage of the property’s value. Therefore you must consider the current market value and whether the outstanding balance fits a lenders desired loan to value requirement. Additionally you will need to decide whether to do a “like for like” remortgage, or “staircase” which involves buying a greater share than you currently own.